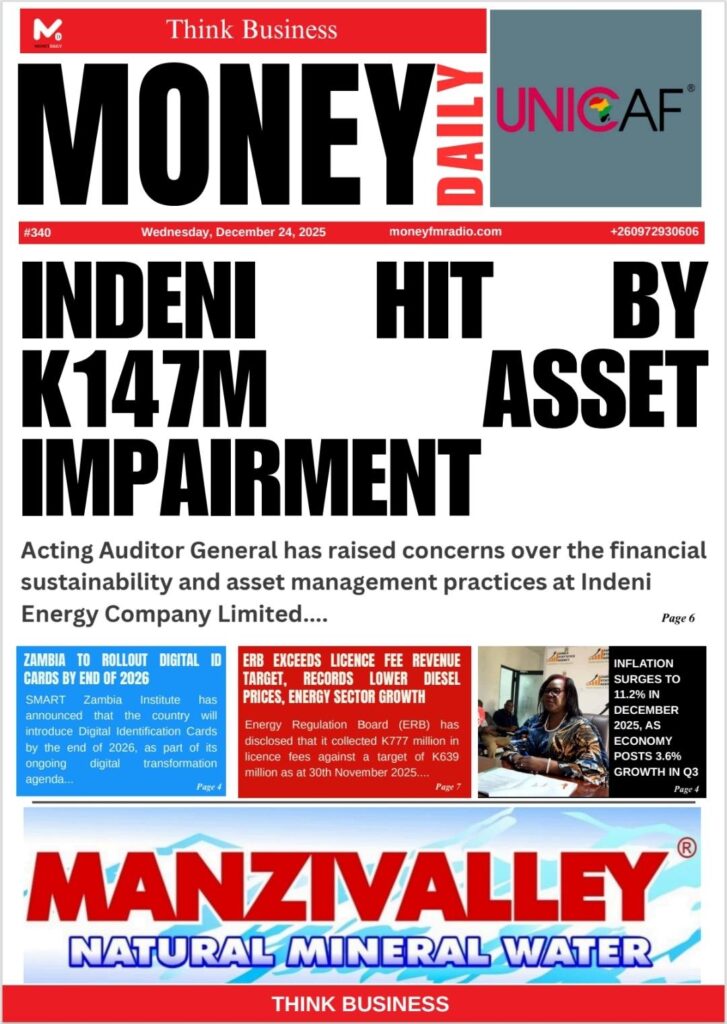

Acting Auditor General has raised concerns over the financial sustainability and asset management practices at Indeni Energy Company Limited.

This follows adverse findings in the Report of the Auditor General on the Accounts of Parastatal Bodies for the financial year ended 31st December 2024.

According to the report, Indeni Energy incurred an impairment charge of K147 million after failing to dispose of decommissioned refinery assets, a situation that Dr. Ron Mwambwa said reflects weaknesses in asset management and strategic decision-making.

He revealed that the company spent K4.84 million on care and maintenance of the idle assets, further straining its already fragile financial position.

The report also reveals that Indeni paid US$521,857 for materials that were never delivered, exposing the company to financial loss and highlighting gaps in procurement controls and contract management.

“At Indeni Energy Company Limited, failure to dispose of decommissioned refinery assets resulted in an impairment charge of K147 million, alongside K4.84 million incurred on care and maintenance,” he said.

Dr. Mwambwa noted that Indeni’s financial health continued to deteriorate in 2024, with the company recording a negative working capital position of K298.2 million, raising concerns about its ability to meet short-term obligations and continue operating as a going concern.

The report also cited the Public Service Pension Fund (PSPF), where actuarial assessments revealed funding gaps of K50.42 billion in 2020 and K43.88 billion in 2023, with pension assets covering only 9 percent of future obligations.

Dr. Mwambwa cautioned that the delay by Government to remit K96.56 million in pension contributions for December 2024, combined with K14.9 million in outstanding rental income, poses a serious long-term fiscal risk to the sustainability of public sector pensions.

Further, the Competition and Consumer Protection Commission (CCPC) was also cited for failing to collect K32.77 million in fines imposed on non-compliant entities, as well as K9.4 million outstanding from settlement agreements.

Dr. Mwambwa warned that such lapses weaken regulatory enforcement and undermine consumer protection and fair market competition.

The Report further highlights Zambia Railways Limited, which recorded operating losses in amounts totaling K315.4 million over 2023 and 2024 and persistent negative working capital exceeding K1.17 billion.

“These losses were largely attributed to an ageing fleet and high operating costs, while rolling stock valued at K447.5 million remained uninsured, exposing strategic national assets to significant financial risk.”

“In the regional transport sector, Tanzania Zambia Railway Authority (TAZARA) incurred maintenance costs of US$7.04 million and revenue losses of US$3.3 million as a result of 405 accidents, most of which were linked to operational and infrastructure deficiencies,”Dr. Mwamba observed.

Dr. Mwambwa also noted that the absence of audited financial statements for three consecutive years, together with uncollected rental income of K71.03 million, continues to undermine accountability within the Authority

He called for enhanced board oversight and decisive management action to restore financial discipline and safeguard public resources invested in the energy sector.