Government has reaffirmed its commitment to fiscal responsibility and predictable debt repayment after releasing K5.26 billion in November, 2025 towards domestic and external debt service, as well as arrears dismantling.

The releases comprised K2.62 billion for domestic debt service, K2.42 billion for external debt service, and K218.23 million for dismantling arrears.

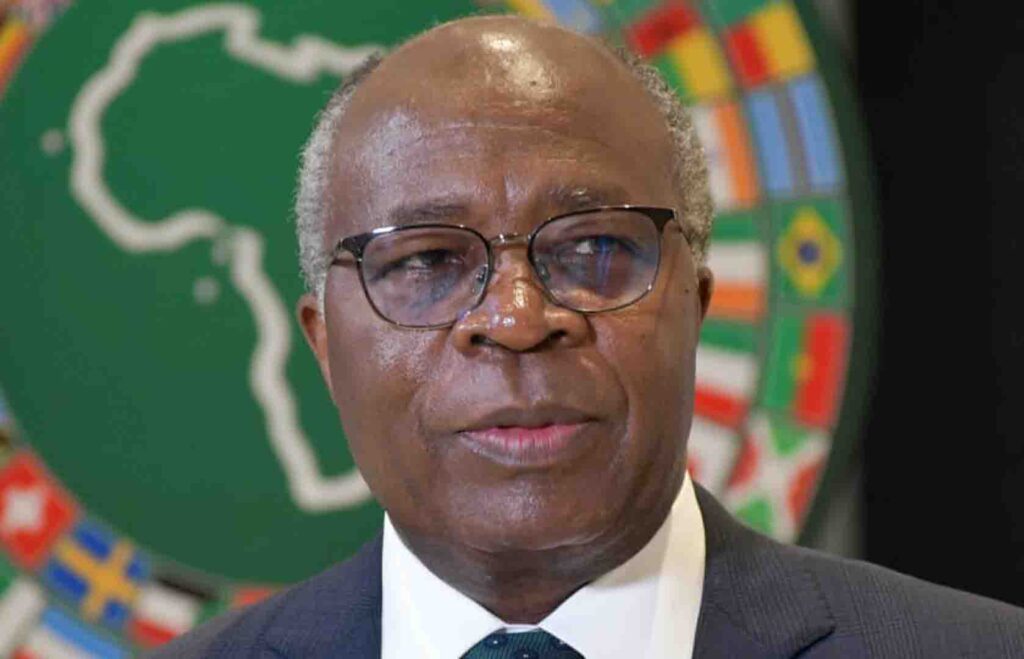

According to Finance and National Planning Minister, Dr. Situmbeko Musokotwane, honouring repayment obligations remains a central pillar of maintaining fiscal credibility, particularly following recent sovereign credit rating upgrades by Standard & Poor’s Global Ratings and Fitch Ratings Agency.

Dr. Musokotwane emphasized that the improved ratings reflect renewed global confidence in Zambia’s economic management, which must be sustained through consistent debt service to prevent the accumulation of new arrears and protect the gains achieved through debt restructuring.

“The release of funds for debt service and arrears, remains critical even in the wake of the recent credit rating upgrades by Standard & Poor’s Global Ratings and Fitch Ratings Agency.The sovereign rating upgrades reflect renewed international confidence in Zambia’s fiscal management, yet that confidence must be sustained through predictable repayment behaviour and ongoing fiscal discipline,” Dr. Musokotwane emphasized.

He said the Treasury’s continued prioritization of debt obligations demonstrates responsible leadership and safeguards Zambia’s standing with creditors and investors.

“As we contemplate the broader narrative of budget integrity and trust, Zambia’s recent credit rating upgrades provide an essential anchor of credibility. The upgrades affirm not only that our fiscal consolidation agenda is advancing with discipline, but also that the architecture of economic management has regained global confidence.”

“We remain committed to debt service to prevent the accumulation of new arrears, preserve the gains made through debt restructuring, and strengthen the country’s standing with creditors, investors and rating agencies,” he added.

In total, the Treasury released K15.56 billion in November for public service delivery, with debt service taking up the largest single share.

Other allocations included K4.63 billion for the public service wage bill, K2.43 billion for transfers and subsidies, K2.04 billion for general Government operations, and K1.2 billion for capital expenditure.

Under subsidies, key expenditures included K700 million for the Farmer Input Support Programme (FISP), K717.37 million for the Constituency Development Fund (CDF) to support infrastructure projects, bursaries, loans and grants to eligible beneficiaries, and K817.16 million to Grant-Aided Institutions—including hospitals and universities—to sustain their operations.

The Minister urged statutory bodies and other government agencies to enhance transparency in reporting their performance, noting that public trust is strengthened when economic progress is visible and measurable.

“The achievements across monetary policy, investment mobilization, revenue performance, procurement reforms, market oversight and operational improvements must be communicated clearly and consistently by the mandated institutions. Public trust will strengthen when progress is visible, verifiable and conveyed in ways that citizens can easily appreciate; we therefore look forward to published performance updates from these institutions, and others,” he said.