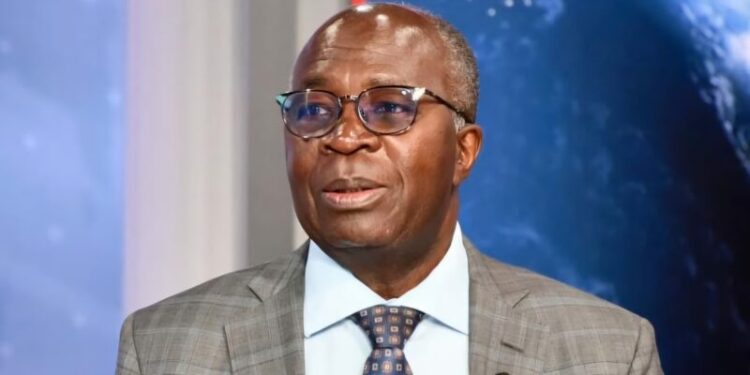

Minister of Finance and National Planning says the appreciation of the Kwacha has clear limits and must be managed carefully to protect the country’s economic stability.

According to Trading Economics, the local unit has continued performing strongly, trading around 18.23–18.58 against the US Dollar as of today, February 17, 2026, marking it as one of the best-performing currencies recently.

Speaking on the performance of the local currency, Dr. Musokotwane Situmbeko cautioned against expectations of the Kwacha gaining strength to the extent of reaching parity with the United States dollar, as such a scenario would be unrealistic and economically destabilizing for Zambia.

“The appreciation of the Kwacha has got its limits. Sometimes I get messages of people on my phone saying, you are doing very well, now can we see one Kwacha equal to one dollar. That should never happen, that cannot happen,” Dr. Musokotwane emphasized.

He explained that if the exchange rate was to reach one Kwacha to one US dollar, it would distort incomes and purchasing power in a way that does not reflect Zambia’s economic realities.

“Imagine for a moment that we got to one Kwacha equal to one dollar, with your salary of, say, K20,000 per month, in one go, your salary is worth US$20,000 per month. That would be a very strange country because there are not many countries in this world where you have a salary of 20,000 dollars per month,” he said.

Dr. Musokotwane noted that such an appreciation would trigger excessive demand for foreign currency as consumers rush to import goods, quickly depleting US dollar reserves.

“Knowing us in Zambia, everyone now wants to import Mercedes Benz so what happens next? Of course, we go to the banks to say, I want US$100,000, US$20,000 to buy a Mercedes Benz , and very quickly, the dollars run out,” Dr. Musokotwane stated.

He added that exporters earning foreign currency would also be negatively affected if they were forced to convert their earnings at an artificially strong exchange rate.

“Those who are earning dollars will say, US$20,000 I have earned from exports, US$50,000 I have earned from exports, now I must get only K50. Of course, they will hide them,” he asserted.

The Finance Minister stressed the need for the country to balance the interests of importers and exporters while maintaining overall economic stability, and commended the Bank of Zambia for managing the foreign exchange market under a liberalized system.

Dr. Musokotwane further emphasized that Zambia’s long-term prosperity depends on expanding exports rather than relying on domestic consumption alone. “Zambia can only grow consistently over time through exports, there is no other way around,” he said.

He explained that increasing output beyond domestic consumption levels makes exports essential, citing maize production as an example.

“Take maize, we encourage farmers to grow 10 million tonnes of maize. It is good for farmers to grow 10 million tons of maize, 20 million, or 30 million tonnes, because this is the way they are going to be rich, by producing more. But can we in Zambia consume 10 million tonnes of maize, or 20 million tonnes of maize? We can’t. The only way to achieve that is through exports. And of course if that is true for maize, it is true for any other commodity,” he stressed.

Dr. Musokotwane reiterated that maintaining a stable and competitive exchange rate, while promoting exports, remains key to ensuring sustained economic growth and shared prosperity for Zambia.