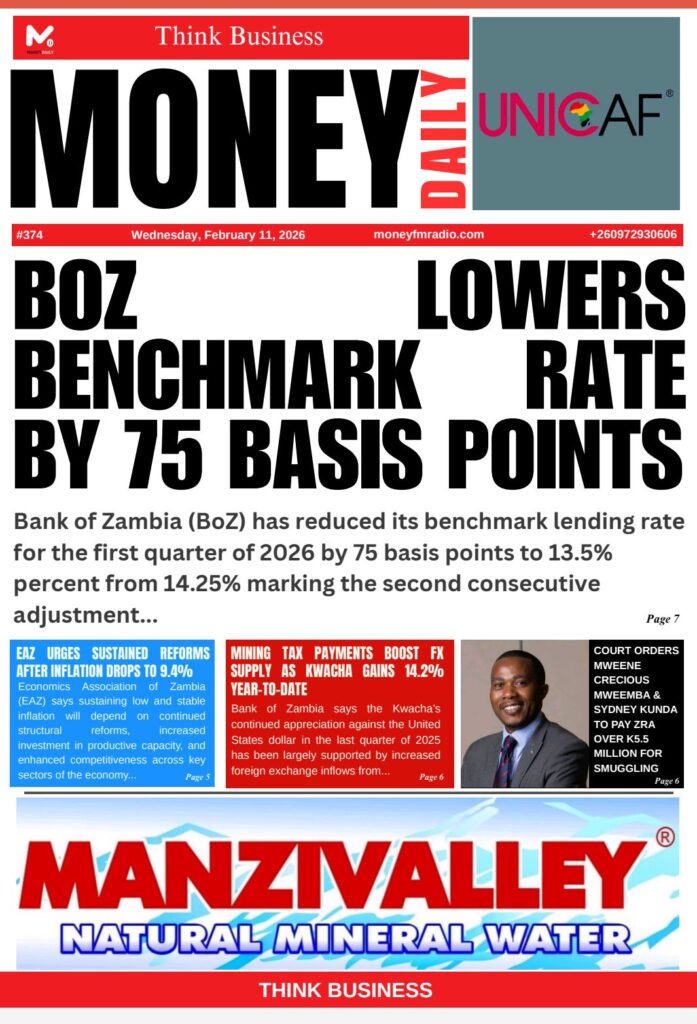

Bank of Zambia (BoZ) has reduced its benchmark lending rate for the first quarter of 2026 by 75 basis points to 13.5% percent from 14.25% marking the second consecutive adjustment.

At its meeting held on 9th and 10th February 2026, the Monetary Policy Committee based its decision on the continued decline in the inflation rate in the fourth quarter of 2025 and the need to maintain an appropriate monetary policy stance.

Zambia’s inflation rate fell sharply in January 2026 to 9.4 percent, down from 11.2 percent in December 2025.

The Central Bank expects inflation to drop faster into the 6 to 8 percent target band than was projected in November 2025.

Central Bank Governor Dr. Denny Kalyalya, told journalists at a media briefing on Wednesday that the decline in inflation has largely been driven by the continued impact of the maize bumper harvest from the 2024/25 farming season and the appreciation of the Kwacha against major currencies.

“Inflation continued to decelerate in the fourth quarter of 2025, with overall inflation declining to 11.2 percent in December 2025 from 12.3 percent in September 2025. In January 2026, inflation fell sharply to 9.4 percent,” Dr. Kalyalya stated.

He said inflation is expected to be within the target band by the second quarter of 2026 and move to the lower bound by the first quarter of 2027.

On average, inflation is projected to be 6.9 percent in 2026 compared to 7.6 percent projected in November 2025.

According to Dr. Kalyalya, inflation is expected to ease further to 6.3 percent in 2027.

“The more positive outlook largely reflects the impact of the lagged effects of the recent appreciation of the exchange rate and expected favourable agricultural output,” he said.

He explained that the risks to the inflation outlook remain tilted to the downside, which include favourable weather conditions, supportive external sector conditions reflected in higher copper prices, and continued macroeconomic stability.

“In view of the recent sharp drop in inflation and projected further decline over the forecast horizon, improving market expectations of inflation, and the need to maintain an appropriate monetary policy stance, the Committee decided to reduce the Policy Rate by 75 basis points to 13.5 percent.”

“Decisions on the Policy Rate will continue to be guided by inflation outcomes, forecasts, and identified risks, including those associated with financial stability,” Dr. Kalyalya added.