Ministry of Finance and National Planning has disclosed that the Treasury allocated K7.4 billion toward domestic and external debt service as well as the dismantling of arrears in January 2026.

Of this amount, K6.6 billion was spent on domestic debt service, K310.1 million on external debt service, and K439.9 million on dismantling domestic arrears owed to suppliers of goods and services.

The allocation formed part of the K23.2 billion released in January to finance public service delivery and sustain the implementation of priority national programmes. From this total, K4.9 billion was spent on the Public Service Wage Bill, while K7.7 billion went toward transfers, subsidies, and social benefits.

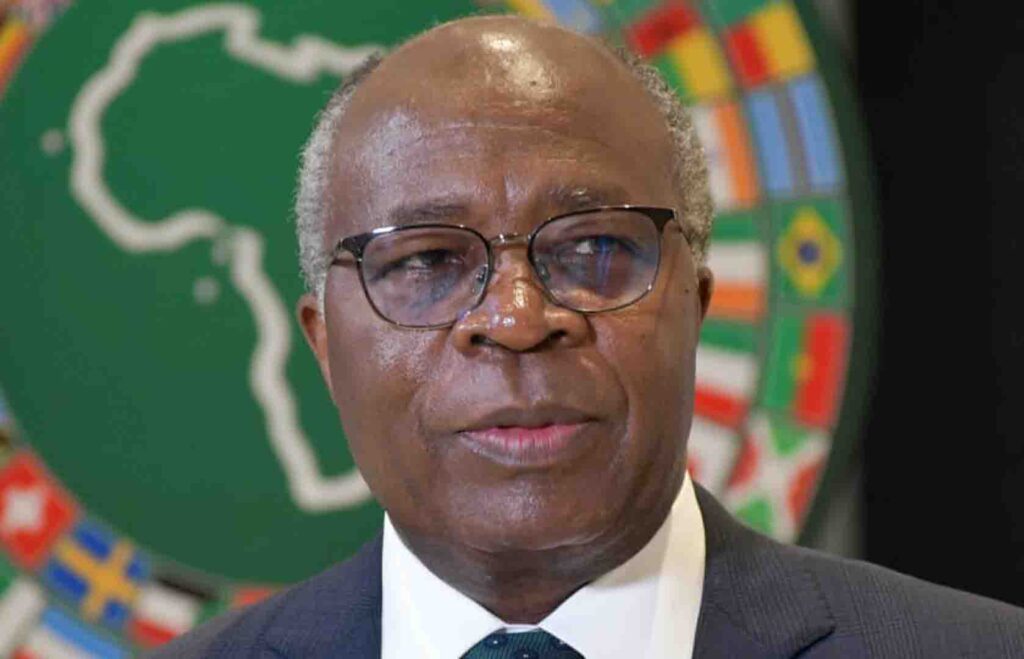

Finance and National Planning Minister, Dr. Situmbeko Musokotwane revealed that the Treasury also released K1.8 billion to facilitate the implementation of Government programmes and general operations, while K1.4 billion was allocated to capital expenditure to support critical infrastructure investments across the country.

Dr. Musokotwane said with respect to transfers, subsidies, and social benefits, the Treasury released K7.7 billion to support livelihoods, protect vulnerable citizens, and sustain key service-delivery institutions.

He explained that of this amount, K1.5 billion went to Grant-Aided Institutions, including hospitals and universities, to support operations; K768.9 million in school grants to advance the Free Education Policy; K300 million for the Constituency Development Fund (CDF); and K120.8 million for the Local Government Equalization Fund.

Dr. Musokotwane added that within the same category, K4.9 billion was released to the Food Reserve Agency (FRA) to settle outstanding obligations to farmers who supplied maize during the 2024/2025 crop marketing season.

“Support to the FRA was applied to conclude outstanding payments linked to the 2024/2025 marketing season, and the Government is not in arrears to farmers. Where isolated complaints may still arise, these are more likely to reflect administrative or banking processing bottlenecks at the last mile, rather than a funding shortfall from Government,” he stated.

The Minister further reported that the Treasury released K147.5 million to clear outstanding dues under the Cash for Work Initiative, with the revised programme set to restart on a clean slate in March/April 2026, strengthening predictability for communities and ensuring that future implementation is measured, timely, and accountable.

“To sustain operational continuity and programme execution across Government institutions, K1.8 billion was released for the implementation of programmes and other general operations in line with approved institutional work-plans and service-delivery requirements,” he said.

“In support of productivity-enhancing investment, the Treasury released K1.4 billion toward capital expenditure to sustain infrastructure development. Of this amount, K655.5 million was for road infrastructure, K67.8 million supported the Rural Electrification Authority (REA), K201.9 million was released for water infrastructure projects, and K440.2 million supported infrastructure development coordinated by various ministries, nationwide.”

Dr. Musokotwane stressed that on the Public Service Wage Bill, Government spent K4.9 billion on personal emoluments for public service workers, including health workers, teachers, security personnel, and overseas allowances for diplomats serving in Zambian missions abroad, thereby sustaining continuity in front-line service delivery.

“In January 2026, the Treasury releases reinforced three signals that matter most to citizens and markets: continuity, credibility, and clean execution. Continuity means essential public services and core Government functions did not stall.

“Credibility means obligations were met in a manner that sustains confidence in the Government’s payment culture and fiscal discipline. Clean execution means the Treasury did not merely release resources—it actively closed out legacy payment lines so that key programmes can move forward without carry-over distortions,” he added.

He said the release of funds also carried a clear message to farmers and communities that the Government is settling verified obligations in an orderly manner.

“Taken together, the January 2026 releases demonstrate the practical character of the 2026 Budget: protecting service delivery now, reinforcing fiscal credibility over time, and resetting priority social interventions so they can deliver results cleanly and consistently as Zambia advances from stabilization into a growth-oriented phase,” Dr. Musokotwane emphasized.

He added that the 2026 National Budget is the first financial plan to be implemented after Government consolidated macroeconomic stability under the IMF-supported Extended Credit Facility (ECF) Programme, and is deliberately structured to translate stability into sustained growth, investment mobilization, job creation, and continued cost-of-living relief.